- The FOMC meeting, coupled with Donald Trump’s post, hinted at a potential end to QT in April.

- Positive sentiment was further fueled by key metrics and notable figures like Brad Garlinghouse addressing the crypto summit.

The crypto markets reacted positively to expectations of reduced monetary system rates for the medium term. FOMC comments were less strict than anticipated, and rising activity in conventional financial markets fueled optimism.

Despite this, rates remained unchanged, with no clear indication of potential reductions.

Jerome Powell, Chair of the Federal Reserve, emphasized that high interest rates are essential to combat inflation. He lowered economic growth projections, suggesting improved market conditions.

However, he attributed economic challenges to aggressive policies implemented during President Donald Trump’s administration.

Arthur Hayes, co-founder of BitMEX, noted on X (formerly Twitter), that Powell had delivered his objectives leading to an expected end of quantitative tightening on the 1st of April.

Hayes said that the true bullish shift would probably emerge from an SLR exemption or the return of Quantitative Easing (QE) measures.

This was backed by a post by Trump on Truth Social reading;

“The Fed would be MUCH better off CUTTING RATES as U.S. Tariffs start to transition (ease!) their way into the economy. Do the right thing. April 2nd is Liberation Day in America!!!”

Hayes saw $77K as the possible bottom for Bitcoin but predicted stocks could decline further before reaching Powell’s desired policies thus investors needed to stay flexible with ample funds.

Market expectations were impacted by predictions of rising inflation rates. Extended high rates were anticipated to have bearish effects.

Analyst Benjamin Cowen confirmed on X that Quantitative Tightening (QT) was ongoing. He stated in response to Hayes;

“QT is not “basically over” on April 1st. They still have $35B/mo coming off from mortgage backed securities. They just slowed QT from $60B/mo to $40B/mo”

Crypto and blockchain business investments

News of a crypto summit featuring Trump, Michael Saylor, co-founder of Strategy, and Brad Garlinghouse, the CEO of Ripple Labs fueled recent market gains.

The summit emphasizes crypto and institutional adoption. Bullish sentiment grew after Trump Media executives launched Renaus Tactical, aiming to raise $179M via a Special Purpose Acquisition Company (SPAC) for blockchain investments.

Increasing organizational interest in crypto continues to boost confidence across the sector. Expectations of more crypto-friendly government policies also contributed to the market gains.

Short liquidations, sentiment, and ETF flows

Additionally, crypto markets gained as demand for short positions decreased, and massive short closures signaled dissolving bearish bets.

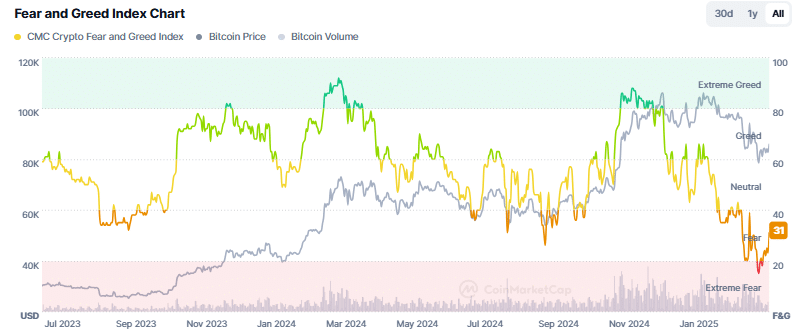

At the time of writing, the Crypto Fear and Greed Index reached 31 points from its previous level of 15 during the last week, which indicated escalating trader positivity and the development of bullish market sentiment.

Bitcoin spot ETFs saw an inflow of $11.7984 million, reflecting increased demand. In contrast, Ethereum [ETH] spot ETFs recorded their eleventh consecutive day of outflows, totaling $11.7459 million.

With Bitcoin leading the crypto markets, this trend signaled strong bullish sentiment.