South Africa Reserve Bank(SARB) governor’s question, “Why not strategic beef reserve?” at the 2025 World Economic Forum in Davos may have been rhetorical, but Lesetja Kganyago’s seemingly sarcastic remark about “strategic bitcoin reserves” inadvertently underscored the need for Africa to rethink its economic strategies in the face of global financial shifts. In a world increasingly defined by digital transformation, the concept of money and value storage is evolving rapidly. Africa is no stranger to commodity-based economies. From oil to gold, beef to cocoa, the continent has long relied on natural resources for economic sustenance. However, these commodities are fraught with challenges. Global commodity prices are highly susceptible to market fluctuations, geopolitical tensions, and climate change. For instance, the price of beef can swing dramatically due to disease outbreaks or trade restrictions, just the way the value of fiat currencies swings and remains unpredictable when traded against digital assets like bitcoin due to regional financial policies and currency devaluation. According to the Food and Agriculture Organization (FAO), beef prices have experienced volatility of up to 30% year-over-year due to factors like foot-and-mouth disease and export bans.

Image Source : FAO

Even though Brian Armstrong, CEO of Coinbase, responded to Kganyago’s question with a compelling argument: Bitcoin is not just a better form of money than gold, it is also more portable, divisible, and utility-driven. Over the past decade, Bitcoin has outperformed every major asset class, cementing its position as a superior store of value. For Africa, a continent often marginalized in the global financial system, a Strategic Bitcoin Reserve could be the key to unlocking economic independence, fostering innovation, and securing long-term prosperity. How?

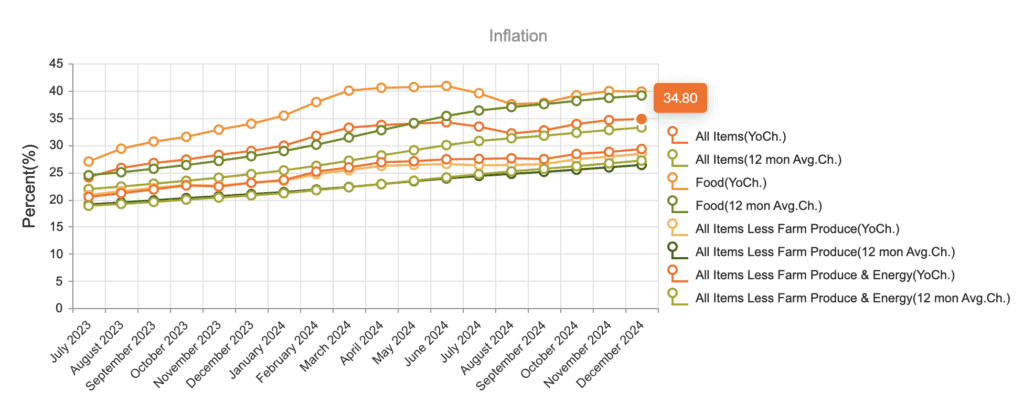

It’s time to be factual and realistic in our comparison. Bitcoin exists digitally and requires no physical storage, commodities like beef and mutton are perishable and costly to maintain. The World Bank estimates that post-harvest losses for agricultural products in Africa amount to $48 billion annually, highlighting the inefficiencies of commodity-based reserves. While commodities have intrinsic value, their utility is restricted to specific industries. Bitcoin, on the other hand, is a global, borderless asset with applications in finance, technology, and beyond while its unique properties make it an ideal candidate for a strategic reserve asset. With a capped supply of 21 million coins, Bitcoin is inherently deflationary, unlike fiat currencies that can be printed indefinitely or beef with endless reproductive mechanisms. According to CoinMarketCap, Bitcoin’s market capitalization has grown from less than 1 billion in 2013 to over 1 trillion in 2025, demonstrating its rapid adoption and value appreciation.

Image Source : CoinMarketCap

WHY BITCOIN OVER BEEF ?

Bitcoin can be transferred across borders in minutes and divided into smaller units (satoshis), making it more practical than gold or beef. Over the past decade, Bitcoin has delivered an average annual return of over 200%, outperforming gold, stocks, and real estate. A study by Fidelity Investments found that Bitcoin’s risk-adjusted returns are superior to traditional assets, making it an attractive option for long-term wealth preservation. Globally, nations are beginning to recognize Bitcoin’s potential as a reserve asset. El Salvador made history in 2021 by adopting Bitcoin as legal tender, while countries like Switzerland and Singapore have integrated Bitcoin into their financial systems. This is 2025 and The United States “Strategic Bitcoin Reserve” Bill is already in the pipeline. According to a 2023 report by Chainalysis, Africa is one of the fastest-growing cryptocurrency markets, with Nigeria, Kenya and South Africa leading in adoption.

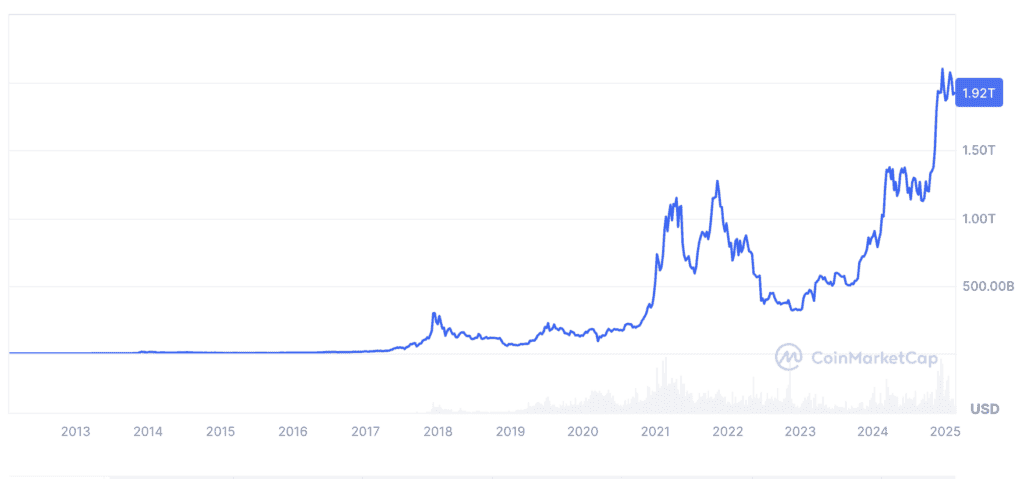

Bitcoin’s deflationary nature makes it an effective hedge against inflation, which has plagued many African economies. For example, Nigeria’s inflation rate hit 34.80% in 2024, eroding the value of the Naira. A Bitcoin reserve could protect national wealth from such devaluation. By allocating just 1% of its reserves to Bitcoin, Africa could unlock billions in value. For instance, if the continent’s combined foreign reserves of 500 billion included 5 billion in Bitcoin, a 10x appreciation in Bitcoin’s value would yield $50 billion in returns. Unlike beef production, which contributes to deforestation and greenhouse gas emissions, Bitcoin mining can be powered by renewable energy. According to the Cambridge Bitcoin Electricity Consumption Index, 58.5% of global Bitcoin mining is powered by renewable energy as of 2021. Africa’s vast solar and hydroelectric potential makes it an ideal location for sustainable Bitcoin mining operations. Storing and managing Bitcoin reserves is far more cost-effective than maintaining commodity reserves. There are no storage costs, no risk of spoilage, and no need for complex logistics.

Image Source : Central Bank of Nigeria.

El Salvador’s adoption of Bitcoin as legal tender provides valuable insights for Africa. Despite initial skepticism, Bitcoin has boosted tourism and foreign investment in El Salvador. According to the Central Reserve Bank of El Salvador, tourism revenue increased by 30% in the first year following Bitcoin adoption. Over 70% of Salvadorans previously lacked access to banking services. Bitcoin has enabled millions to participate in the global economy. By reducing reliance on the U.S. dollar, El Salvador has taken a bold step toward financial independence. Many African nations rely heavily on the U.S. dollar for trade and reserves, leaving them vulnerable to external economic policies. Bitcoin offers a decentralized alternative, reducing reliance on traditional financial systems.

By establishing a Strategic Bitcoin Reserve, Africa can secure its economic future, protect its wealth from inflation, and position itself as a global leader in the digital economy. The time has come for Africa to move beyond outdated economic models and embrace the future of money. As Brian Armstrong aptly stated, Bitcoin is not just a better form of money; it is the foundation of a new financial paradigm. For Africa, the choice is clear: Bitcoin, not beef, is the path to prosperity. Bitcoin represents a transformative asset class that offers unparalleled advantages over traditional commodities like beef or mutton.

This is a guest post by Heritage Falodun. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.