Bitcoin continues to face massive selling pressure, with its price dropping below the $84,000 mark, marking a 15% decline since the start of March. This downturn has fueled panic selling and rising fear, with many investors now speculating whether Bitcoin is entering a bear market. The recent decline has left the market in a state of uncertainty as BTC struggles to reclaim key levels that could restore bullish momentum.

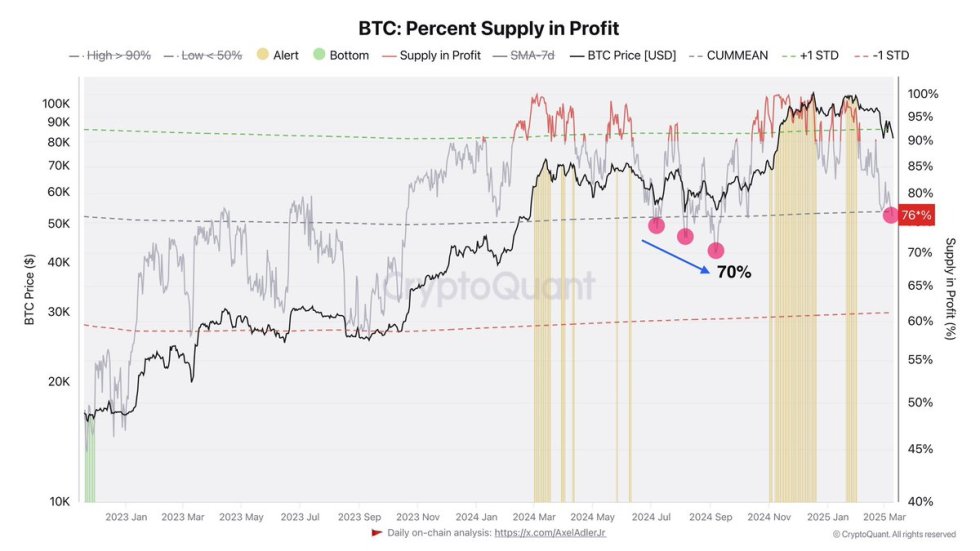

According to on-chain data from CryptoQuant, the percentage of Bitcoin supply in profit has dropped from 99% to 76%, meaning that 23% of the total BTC supply is now in an unrealized loss. Historically, such large declines in supply profitability have led to heightened volatility as weaker hands capitulate while long-term holders assess market conditions.

With Bitcoin at a critical juncture, traders are closely watching whether BTC can reclaim key resistance levels or if further downside pressure will push prices even lower. The coming days will determine whether Bitcoin is set for a recovery or deeper losses ahead.

Bitcoin Faces A Critical Test

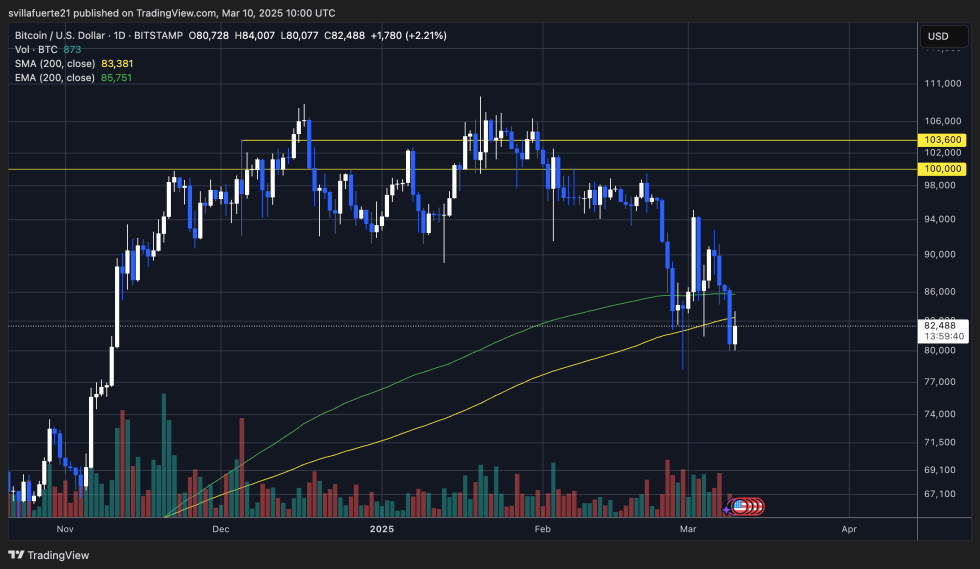

Bitcoin is struggling to reclaim higher prices, with weak price action and intense fear continuing to dominate sentiment. Many analysts are now calling for the end of this bull cycle, as BTC lost the $90,000 level weeks ago, failing to regain its previous momentum. Currently, Bitcoin is stuck below $85,000, barely holding above $80,000, as bearish pressure keeps investors on edge. The market remains in a vulnerable position, with many expecting a further drop into lower demand levels.

However, there is still hope for a recovery, as BTC could reclaim key levels and reignite buying interest. Top analyst Axel Adler shared insights on X, revealing that the percentage of Bitcoin supply in profit has dropped from 99% to 76%, meaning that 23% of the total BTC supply is currently in an unrealized loss. This equates to approximately 4,561,966 BTC out of 19,834,633 BTC in circulation, marking a significant shift in market profitability.

Adler further noted that such a decline could trigger panic among inexperienced investors, potentially fueling more selling pressure. However, he pointed out that a similar trend occurred during the previous consolidation phase, when the percentage of supply in profit dropped to 70%, confirming macro market cycles that often precede strong recoveries.

For now, Bitcoin remains in a delicate position, with the next few trading sessions set to determine whether BTC can reclaim higher resistance levels or if bears will extend the current downtrend. Investors are closely watching whether this cycle mirrors past consolidations or if deeper losses are ahead.

BTC Price Action: Technical Details

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.